🔎 Several provisions of the Tax Cuts and Jobs Act (TCJA) of 2017, enacted by former President Donald Trump, are set to expire at the end of 2025, without changes from Congress.

The law included lower tax brackets, a higher standard deduction, and a boost to the child tax credit, among others. However, the future of these provisions is unclear with uncertain control of the White House and Congress.

President Joe Biden and Trump have expressed similar positions on extending TCJA provisions for the middle class, but it is difficult to predict the future of these tax breaks.

➡️ Let’s look at how the TCJA affected most individual taxpayers, and how it might change after 2025:

🔸Individual Rates

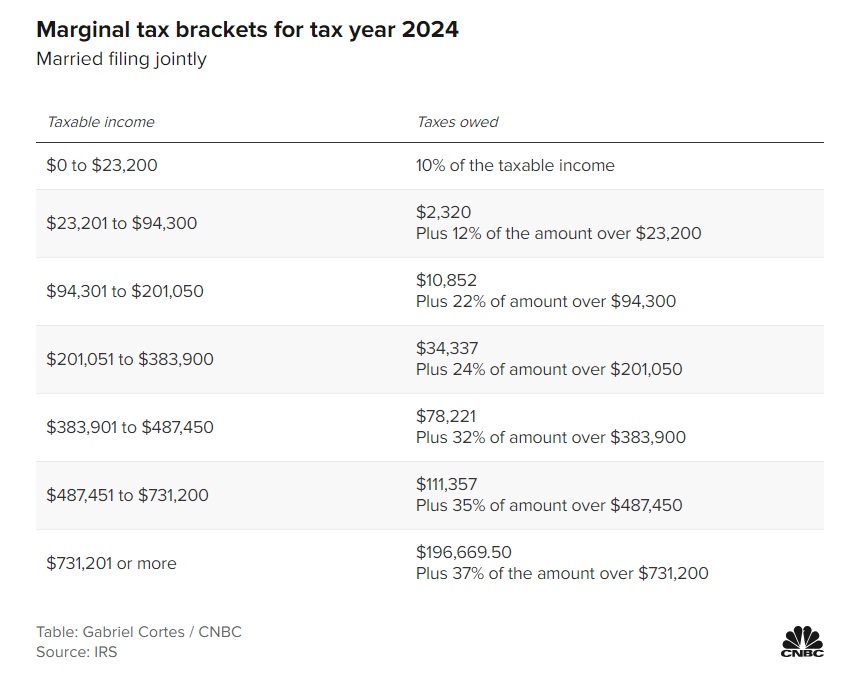

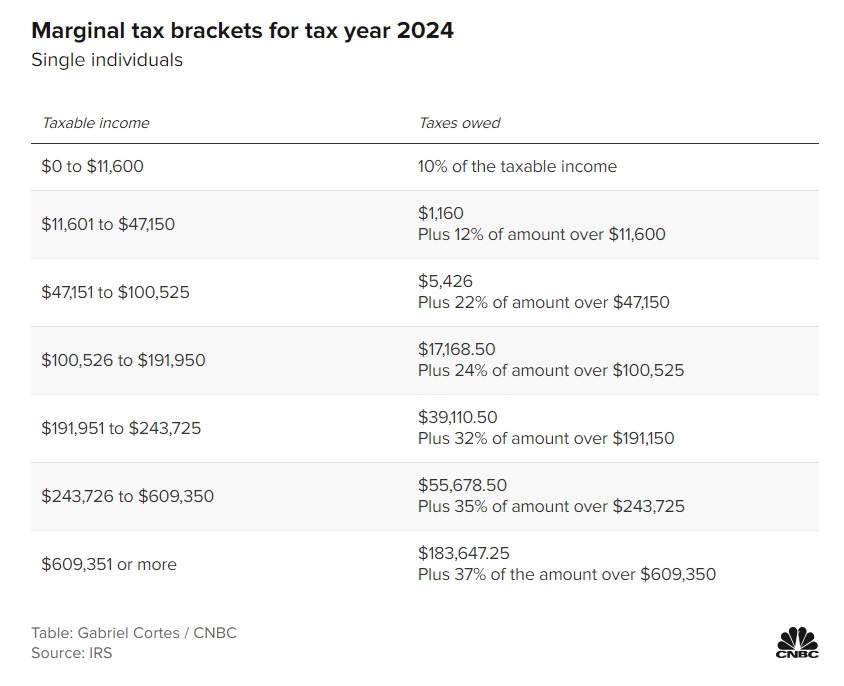

The TCJA reduced federal income tax rates across the board, with the top rate dropping to 37% from 39.6%.

Without Congressional updates, they will return to previous levels after 2025. Thus, federal income tax rates will go to 10%, 15%, 25%, 28%, 28%, 33%, 35% and 39.6%.

You may also like: Hiring Your Kids Can Bring You Tax Benefits

🔸The Standard Deduction Could Decrease

When filing your income tax return, you can take either the standard deduction or itemized deductions, whichever is greater, and both options reduce taxable income.

Some itemized deductions include charitable donations, a certain percentage of medical expenses, and state and local taxes (SALT), a tax break that TCJA limited to $10,000. The latter is scheduled to expire in 2025.

TCJA nearly doubled the standard deduction, which made filers less likely to itemize tax breaks. Prior to 2018, about 70% of taxpayers claimed the standard deduction, compared to 90% in year 2020.

🔸Child Tax Credit May Fall

The TCJA boosted the child tax credit by doubling the maximum tax credit to $2,000, increasing the refundable portion to $1,400 and expanding eligibility. All of this will return to 2017 levels if there are no changes from Congress.

🔸Relating to Wealthy Individuals

Federal gift and estate exemptions also increase through 2025, allowing more very wealthy Americans to pass assets tax-free to the next generation.

In 2024, the tax-free limits on lifetime or death gifts increased to $13.61 million per individual or $27.22 million for spouses, but will be cut roughly in half in 2026.

📌 Note

It is important to know that all of these potential changes to the TCJA provisions will decisively influence the tax landscape for Americans, if and when Congress does not take action.

✅ Therefore, we at Wave Tax recommend having an advisor to prepare you or your business in the event of any major changes to the country’s laws.

📩 Contact us at info@wavetax.us