Key Points

- You can open a traditional or Roth IRA quickly and easily through many banks or brokerage firms, and to do so, you need to earn taxable income. If you fund your IRA with tax-deductible contributions, your taxable income will be reduced by that amount.

- There are income requirements to open a Roth IRA, which is funded with after-tax money, although your earnings and withdrawals are not taxed in retirement.

- When it comes to saving for retirement, you may be on your way with automatic contributions to a 401(k) account, but this is not the only option.

A Unique Way for Saving

An individual retirement account (IRA) offers a unique way to save for the future, you can choose a traditional IRA, Roth IRA or work with both. If you’re self-employed or a small business owner, you have even more options.

And the best part? All IRAs give you an advantage when it comes to funding a healthy retirement.

✅ Four Benefits of a Traditional or Roth IRA

• IRAs are Affordable and Easy to Set Up

Most people can open and contribute to an IRA, and you (or your spouse) only have to earn taxable income.

There is no age limit to open or contribute to a Roth IRA, but your ability to contribute may be reduced depending on your tax situation and the amount of your modified adjusted gross income. You can open an IRA through many banks or brokerage firms in a matter of minutes, and most financial institutions make it easy to manage your account.

In addition, you can manage your investments on your own or work with a financial professional to help guide your strategy. On the other hand, you can also opt for an automated approach, where your investments are automatically monitored and rebalanced to help you reach your goals.

🔎 Don’t forget that your combined Traditional and Roth IRA contribution is $6,000 for tax year 2022, increasing to $6,500 for tax year 2023, and you can contribute an additional $1,000 if you are age 50 or older.

• Advantages of Traditional IRAs Include Immediate Tax Deduction

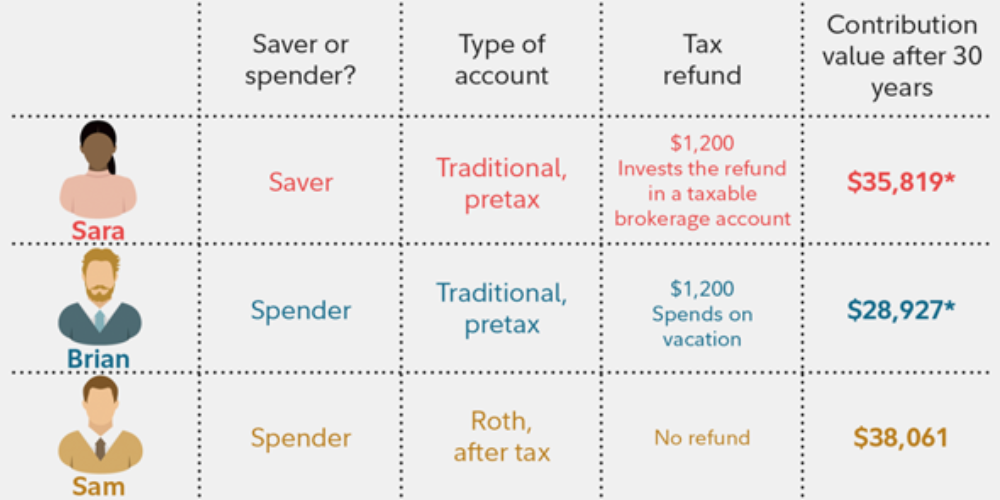

Traditional IRAs offer the key advantage of tax-deferred growth, which means you won’t pay taxes on your earnings or untaxed contributions until you are required to begin making minimum distributions at age 73.

With traditional IRAs, you invest more up front than with a regular brokerage account, and the more you invest now, and over the years, the more you’ll have to withdraw when you’re ready to retire.

Another important point is that your contributions to a traditional IRA may be tax deductible, depending on whether you, or your spouse, have a workplace retirement savings plan, as well as your income level.

You can also like: Learn about Tax Advantages of Traditional and Roth IRAs Accounts

• Advantages of Roth IRAs Include a Tax Deduction in Retirement

While a traditional IRA may give you an initial tax break, the Roth IRA gives you that advantage when you’re ready to retire. Since you contribute after-tax dollars, your earnings and withdrawals are not taxed in retirement, which is a big advantage for investors, especially younger ones.

If flexibility is a priority, a Roth IRA may be right for you. With tax-free withdrawals in retirement, no required minimum distributions and the ability to withdraw your contributions at any time, Roth IRAs make it easy to cash out.

• Your IRA is Uniquely Yours

In 2022, the Bureau of Labor Statistics reported that 72% of Americans have access to company-sponsored retirement benefits, such as a 401(k) plan. Even if you have one, the IRA allows you to avoid some 401(k) pitfalls.

For example, with the 401(k) plan you are a mere participant, not an owner. Your company can change plans or limit investment options without your consent, and if you leave your job, you lose the ability to continue contributing to that plan.

An IRA, however, is owned by you, and access is no different if you change jobs, and you can even roll over funds from your old 401(k) plan into your IRA. Plus, we can’t forget that IRAs offer thousands of investment options, such as stocks, bonds, mutual funds, exchange-traded funds (ETFs) and more.

With an IRA of your own, you can manage your portfolio according to your financial needs, risk profile and retirement goals.

✅ Remember, Wave Tax is here to help you organize your finances – contact us at info@wavetax.us