Recent reports confirm that the US Internal Revenue Service (IRS) is preparing to implement the largest staff reduction in decades.

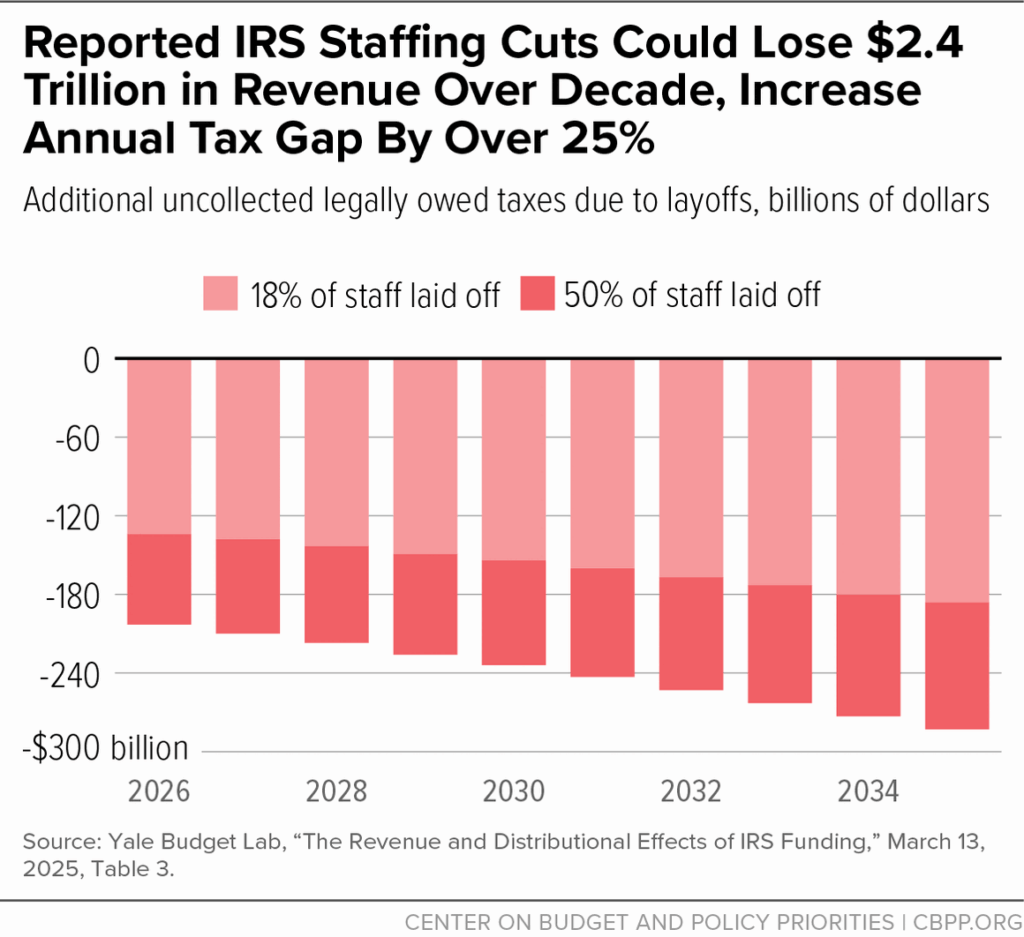

According to internal documents obtained by multiple media outlets, the agency could lose up to 40% of its current workforce, leaving its staff at levels not seen since before the Biden administration.

The data analyzed shows that the IRS, which had more than 100,000 employees during the peak of hiring under the current administration, could reduce its staff to between 60,000 and 70,000 workers.

This drastic decrease represents the loss of approximately 30,000 to 40,000 jobs, returning to staffing levels similar to those existing before 2021.

The first termination notices will begin to be distributed this week, according to internal sources who requested anonymity.

This process coincides with one of the most critical periods for the agency: the peak tax filing season, when the workload of employees reaches its annual peak.

You may also read: IRS Tax Refund Schedule 2025: When to Expect Your Payment

Structural Causes of the Institutional Crisis

The IRS has been plagued by a series of problems that have contributed to this critical situation. The agency has undergone three leadership changes so far this year, creating a leadership vacuum and discontinuity in strategic projects.

In addition, it has faced recent controversies over the handling of confidential taxpayer data, which has significantly damaged its institutional credibility.

Political analysts point out that the agency has become a key player in the debate between Democrats and Republicans over the appropriate size of the federal government, suffering the consequences of this partisan struggle.

Tax policy experts warn of multiple negative consequences of this massive reduction. The system could face collapse in response times, with historic delays in taxpayer service and tax return processing.

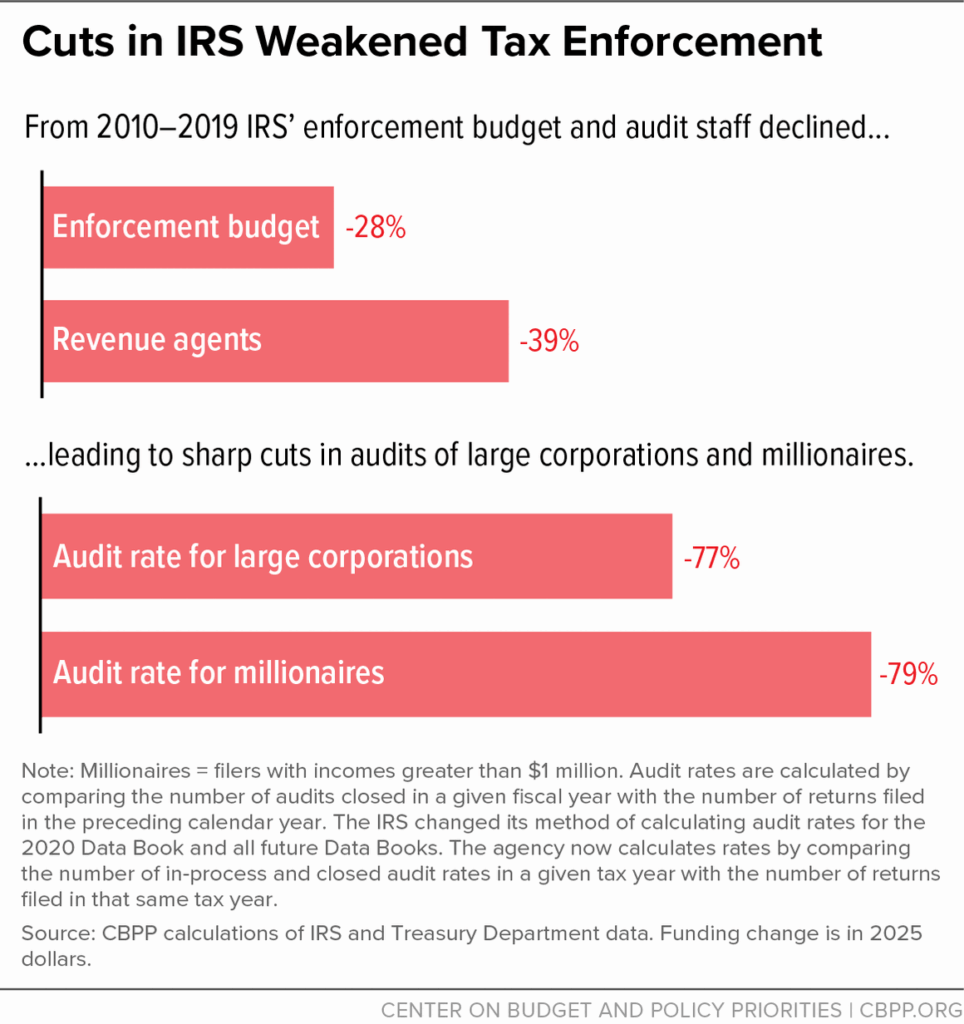

The ability to audit large corporations and high-income taxpayers would be particularly affected, as would the retention of institutional knowledge accumulated by employees with years of experience.

IRS and The Paradox of Available Resources

It is particularly contradictory that these cuts are occurring when the IRS has an additional $80 billion approved during the Biden administration, funds specifically earmarked for modernizing obsolete systems, hiring and training new staff, and improving collection mechanisms.

The Treasury Department has remained remarkably silent on the issue, limiting itself to confirming that the workforce had already returned to pre-2021 levels.

This official silence has led to speculation about possible political interference in the process and the lack of a clear plan to maintain the agency’s critical operations.

This situation is not isolated within the US government landscape. According to data compiled by CNN, more than 120,000 federal employees have lost their jobs since January in what appears to be a massive reorganization of the public sector.

Numerous cases are being legally challenged by unions and professional associations alleging irregularities in the dismissal processes.

Human and Operational Consequences

Thousands of civil servants find themselves in a state of job uncertainty, not knowing whether they will keep their jobs in the coming weeks.

This environment has led to a notable deterioration in team morale and productivity, as well as encouraging a brain drain to the private sector.

Operationally, there is concern about the agency’s ability to maintain essential services during this transition period.

This IRS crisis reflects fundamental tensions in the US public administration, where the need for fiscal efficiency, partisan political demands, and civil servants’ labor rights converge.

The coming months will be crucial in determining whether the agency can maintain its essential functions with a drastically reduced workforce or whether these cuts will mark the beginning of deeper problems in the country’s tax system.