Tax season is here, and many taxpayers are worried about potential refund delays following President Trump’s announcement of significant IRS staff cuts during this critical period.

Tax experts confirm these concerns are valid and recommend filing as early as possible this year, as delays could worsen closer to the April 15 deadline (unless an extension is requested). The IRS began accepting returns on January 27.

Trump is expected to dismiss over 6,000 IRS employees as part of his plan to shrink the federal workforce. Terrance Hutchins, an accountant at Logos Financial Group, anticipates longer wait times and slower customer service.

While simple, electronically filed returns may still be processed normally, errors or last-minute filings could face significant delays.

You may also read | IRS Issues Tax Refund Update: Over $100 Billion Returned to Taxpayers

How Will the Cuts Affect Refunds?

Accountants stress the importance of filing early this year, especially since a smaller IRS workforce means longer turnaround times for correcting errors or answering questions.

At Wave Tax, we always advise our clients to be patient, and we warn about increasing telephone wait times, a major problem for older taxpayers who are less comfortable with digital tools.

Democratic senators warned in a letter to the Trump administration that the cuts would “delay refunds, harm taxpayer services, and weaken tax enforcement.”

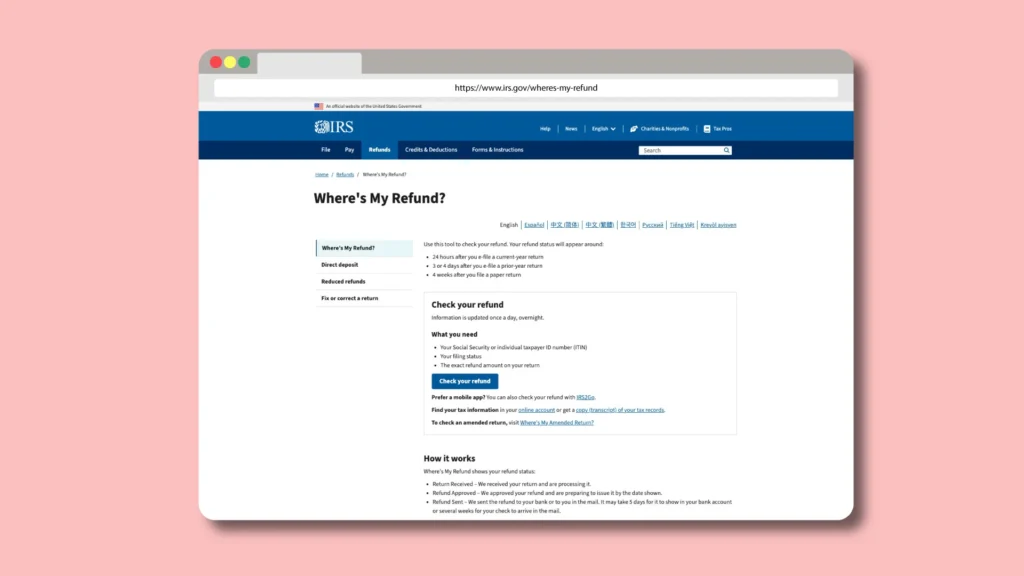

The IRS states that most electronic refunds are issued within 21 days, though errors or paper filings may take longer. Taxpayers can track refunds using the Where’s My Refund? tool by entering their SSN, filing status, and exact refund amount.

Who Relies on Timely Refunds?

Millions of Americans, particularly low-income families who depend on credits like the Child Tax Credit or Earned Income Tax Credit, need these funds to pay bills, reduce debt, or save.

The IRS offers Direct File, a free service in 25 states that speeds up filing by pulling taxpayer data directly from IRS records. Using it may increase the chances of an on-time refund.

The Where’s My Refund? tool updates statuses 24 hours after e-filing (or four weeks for mailed returns).

If delays persist, contacting the IRS is an option, though long phone wait times are expected due to staffing cuts.

📌 Wave Tax Recommends:

- Filing on time;

- Avoiding errors;

- Choosing electronic options to minimizing delays in a year when the IRS is short-staffed.

📌 If requiring guidance regarding you or your company’s tax obligations, please feel free to reach out to us at info@wavetax.us