The IRS has started processing refunds for the 2024 tax year, with most taxpayers receiving their money within 21 days of filing.

The average refund amount is approximately $2,825, based on last year’s data. More than 140 million tax returns are expected this season, with over half prepared by professional tax services.

Refund processing times vary depending on how you file and receive your payment:

- Electronically filed returns with direct deposit are the fastest, typically taking about three weeks. E-filed returns requesting a paper check take closer to four weeks;

- Mailed paper returns take longer, with direct deposit refunds processing in four to eight weeks and paper checks taking four to nine weeks.

These timelines begin once the IRS accepts your return, not your filing date. Delays can occur due to errors, high filing volume, or other issues.

Common Refund Delays

Several factors can delay your refund. Filing during peak season (mid-March through April) often results in longer wait times.

Returns claiming certain tax credits, such as the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC), may be held for additional review until March.

Mistakes on your return or outstanding tax debts can also slow down the process, as the IRS may use part or all of your refund to cover what you owe.

You may also read | 2025 Tax Reform: Comprehensive Guide to Upcoming Fiscal Changes

Tax Refund Calendar 2025

Here is a general estimate of when you may expect your 2024 federal tax refund:

| Date return is filed and accepted: | Date Direct Deposit may arrive: | Date mailed check may arrive: |

|---|---|---|

| January 27 | February 17 | March 28 |

| February 3 | February 24 | April 4 |

| February 10 | March 3 | April 11 |

| February 17 | March 10 | April 18 |

| February 24 | March 17 | April 25 |

| March 3 | March 24 | May 2 |

| March 10 | March 31 | May 9 |

| March 17 | April 7 | May 16 |

| March 24 | April 14 | May 23 |

| March 31 | April 21 | May 30 |

| April 7 | April 28 | June 6 |

| April 15 | May 6 | June 16 |

Note: The above table is an estimate and can be influenced by several factors, including but not limited to processing delays, tax credits claimed, and whether you filed during the busiest time of the season.

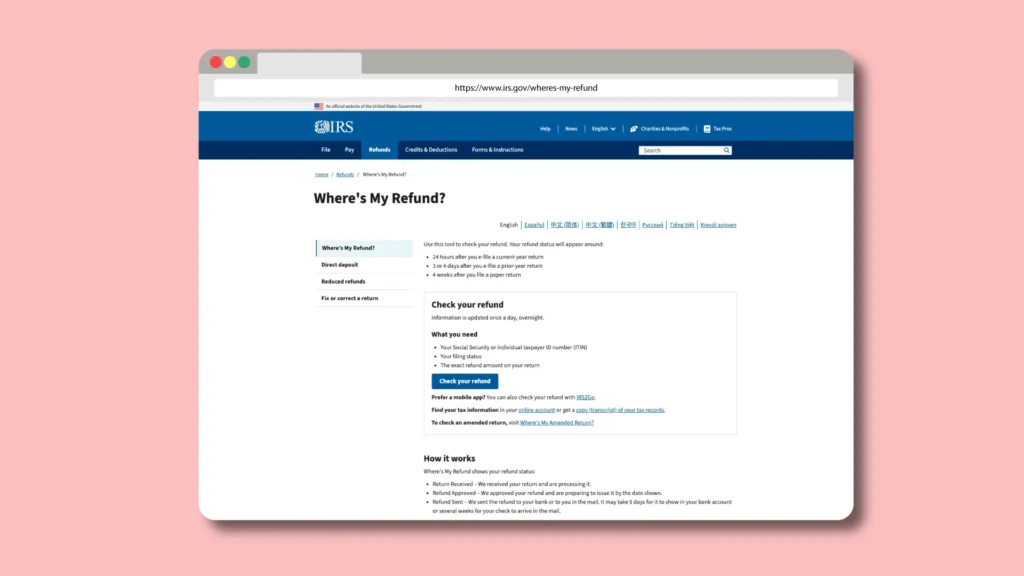

How to Track Your Refund

To check your refund status, use the IRS “Where’s My Refund?” tool online, which updates once daily. You can also track your refund through the IRS2Go mobile app or by calling the automated IRS refund hotline at 800-829-1954.

🛑 State tax refunds follow different schedules. Some states, like Arizona and New York, process e-filed returns in as little as two to four weeks, while others, including North Carolina and California, may take up to 12 weeks for paper filings. For exact timelines, check your state’s Department of Revenue website.

For the fastest refund, always e-file and choose direct deposit. Ensure all personal and banking information is accurate, and file early if possible to avoid peak-season delays.

Most refunds arrive within 21 days, but if yours hasn’t arrived after four weeks for e-filed returns (or eight weeks for mailed returns), contact the IRS for assistance.

✅ Don’t forget that at Wave Tax, personalized planning based on a thorough analysis of your specific circumstances will be more important than ever in this year of tax transition.