Many taxpayers are keen to submit their returns in order to receive a refund; however, it is crucial to first collect all necessary tax documents to avoid an audit.

It is essential to remember that submitting an incomplete return can alert the Internal Revenue Service (IRS), potentially delaying processing or even triggering an audit.

The IRS employs advanced software that cross-references information returns with what is reported on your return, which means discrepancies can lead to an audit flag.

Although the IRS typically processes most tax refunds within 21 days, some returns may require further review, resulting in longer wait times.

You may also read: The IRS to Provide «Free File Software» Ahead of the Tax Season

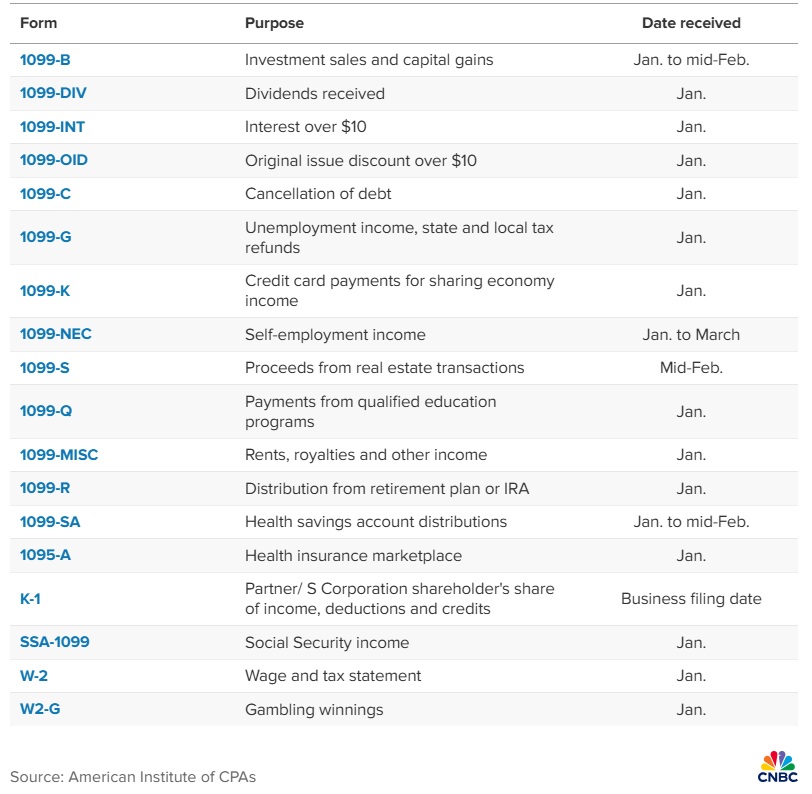

When to Expect the Forms

While many tax forms are sent out in January, others may not arrive until mid-February, March, or even later. Investment returns, in particular, are often among the last to be issued, especially for more complex assets.

For income reporting, your tax documents may include a W-2 for wages, 1099-NEC for contract work, 1099-G for unemployment benefits, and 1099-R for distributions from retirement plans.

It is important to note that your return must accurately reflect all income, even if you do not receive a specific tax form.

🔎 Keep in mind: “If you earn it, it’s reportable, and you’re responsible for it.”

Attention to Mail

As tax documents begin to arrive, staying organized is vital.

At Wave Tax, we always recommend that our clients regularly check their mail. Additionally, some forms may be sent digitally, so it is wise to periodically review your online accounts for any updates.

Using your previous year’s tax return as a checklist can be helpful, but be aware that your current situation may require a different number of tax forms this year.

Recommendation

✅ Being prepared and having your returns ready can help you avoid complications.

Remember, at Wave Tax, our team of professionals is here to assist you in staying informed and providing the tax guidance you or your business may need.

Contact us at info@wavetax.us